Motor Insurance - Choose the one that’s right for you.

First Class Motor Insurance, for great coverage that’s just right

You can now enjoy the roads without worries with our First Class Motor Insurance that’s ready to protect you under any circumstances. Whether it’s life, responsibility towards the third party and the insured, including theft and fire, you can be sure we can keep you protected. We have many professional auto repair shops within our network nationwide that are more equipped with the best technologies. The TVI Smart Solution allows us to track where the accident happens as it happens, making our service fast and impeccable.Details of coverage

Display all the information

Hide all the information

-

What type of car is best suited for this type of insurance?

What type of car is best suited for this type of insurance?

Best suited for those that look for an all-around coverage. For drivers who have just purchased a new car or new drivers that are more at risk with accidents, this plan provides the highest confidence and the best protection for all the unexpected incidents that might occur. This plan is also highly suitable for cars that do the heavy lifting on a daily basis.

-

In what cases does this plan cover?

In what cases does this plan cover?

Highest protection in all cases, this includes protection from collisions and other damages such as fire, loss of vehicle, Medical Expenses Abroad resulted from an accident, even the cost for bail. In the case that the insured is being prosecuted, please study the table below.

ความรับผิดต่อความเสียหายบุคคลภายนอก

Coverage Coverage limit (Baht) Sedan

Van

Pickup

Life/Body and well-being/persons 1,000,000 500,000 1,000,000 Life/Body and well-being/Number of incidents 10,000,000 10,000,000 10,000,000 Property/Number of incidents 5,000,000 2,500,000 5,000,000 ความรับผิดต่อผู้เอาประกัน

Coverage Coverage limit (Baht) Sedan

Van

Pickup

Damages to the vehicle and parts. Per sum insured Per sum insured Per sum insured Fire and damages including parts. Per sum insured Per sum insured Per sum insured Coverage for personal accident / Person 200,000 (7 person) 100,000 (12 person) 200,000 (3 person) Coverage for medical care / Person 200,000 (7 person) 100,000 (12 person) 200,000 (3 person) The driver’s bail in case of lawsuit/ Number of times 200,000 200,000 200,000 -

Coverage condition

Coverage condition

Document title File size Terms of Coverage Motor Insurance Type 1 1410 Kb

Second Class Motor Insurance. Heavy on coverage, light on the wallet.

You can always feel confident that we offer the best coverage with the cost of service that doesn’t break the bank. This special Second Class Insurance guarantees to offer the coverage that can’t be beaten, whether it’s loss of the vehicle, fire or even a collision, we’ve got you covered along with many other special privileges with the best service. All that and you can still rest easy at the starting service price of just 7,300 THB per year.Details of coverage

Display all the information

Hide all the information

-

What type of car is best suited for this type of insurance?

What type of car is best suited for this type of insurance?

This plan is best suited for drivers who are experienced and are confident on the road but still want a plan that’s similar to First Class in case there’s a loss of vehicle, a fire, or responsibility towards a third party. This also includes repairs in the case of a collision with another land vehicle.

-

In what cases does this plan cover?

In what cases does this plan cover?

The coverage for this plan goes across many cases such as loss of vehicle, fire, a collision with a third party or an act of terrorism. We also include coverage in Medical Expenses Abroad when you get into an accident and need in-patient care from a hospital, costs of travel when your vehicle is in repair and extra help provided for your family and loved ones when an unexpected incident happens. Please find more information from the table below.

Coverage Deductible for initial damage ฟรีทุกครั้ง Loss of vehicle and fire 100,000/200,000/300,000/400,000/500,000บาท A collision with a third party’s land vehicle 100,000/200,000/300,000/400,000/500,000บาท Responsibility towards a third party’s life and body 500,000 บาท/คน Responsibility towards a third party’s life and body 10,000,000 บาท/ครั้ง Responsibility towards a third party’s property 1,500,000 บาท/ครั้ง Personal accident up to 7 people 100,000 บาท/คน Medical Expenses Abroad up to 7 people 100,000 บาท/คน Bail for the driver 200,000 บาท/ครั้ง Terrorism ไม่คุ้มครอง Unlimited compensation in the case of the driver or the passengers require in-patient care in a hospital 5,000 /คน /อุบัติเหตุ Compensation for the family in case of death of the driver or the passengers. 10,000 /คน Unlimited compensation for travelling in the case of the insured vehicle requires repair due to a collision with a land vehicle. 1,000 /การเข้าซ่อม -

Special Privileges

Special Privileges

Special Privileges just for you.

Special Privileges just for you.- Repairs can be done in any of more than 1,000 auto repair shops full of experts in our network.

- Free legal fees.

- Free 24-Hour emergency assistance nationwide.

- Color repairs throughout your contract

- Service that provide you with transportation when you choose to put your vehicle in repair.

-

Coverage condition

Coverage condition

Document title File size Terms of Coverage Motor Insurance Type 2 Plus (2+) 1720 Kb

Third Class Motor Insurance. Heavy on coverage, light on the wallet.

This special Third Class Motor Insurance plan provides coverage not just for you but also for your family, making sure you can go on the road without worries. With cost of service starting at just 6,300 THB a year, it’s the coverage that can give you a whole lot more.Details of coverage

Display all the information

Hide all the information

-

What type of car is best suited for this type of insurance?

What type of car is best suited for this type of insurance?

This type is best suited for the car you love, but it should have been with you for a period of time because it’s less at risk of loss than a brand new vehicle. This plan is best suited for vehicles that have low risk of theft and fire, the most basic care you can give to the car you cherish.

-

In what cases does this plan cover?

In what cases does this plan cover?

This type of insurance still provides you with the coverage that goes across many areas such as your life, third party’s property, damages from a collision when the third party is a land vehicle and protects your car from terrorism. We also include help when you are admitted as an in-patient in a hospital due to an accident, help for your family and costs of travel for when your vehicle is in repair. Please find out more from the table below.

Coverage Deductible for initial damage ฟรีทุกครั้ง A collision with a third party’s land vehicle 100,000/200,000 บาท Responsibility towards a third party’s life and body 500,000 บาท/คน Responsibility towards a third party’s life and body 10,000,000 บาท/ครั้ง Responsibility towards a third party’s property 1,500,000 บาท/ครั้ง Personal accident up to 7 people 100,000 บาท/คน Medical Expenses Abroad up to 7 people 100,000 บาท/คน Bail for the driver 200,000 บาท/ครั้ง Terrorism ไม่คุ้มครอง Unlimited compensation in the case of the driver or the passengers require in-patient care in a hospital 5,000 /คน /อุบัติเหตุ Compensation for the family in case of death of the driver or the passengers. 10,000 /คน Unlimited compensation for travelling in the case of the insured vehicle requires repair due to a collision with a land vehicle. 1,000 /การเข้าซ่อม -

Special Privileges

Special Privileges

Special Privileges just for you.

Special Privileges just for you.- Repairs can be done in any of more than 1,000 auto repair shops full of experts in our network.

- Free legal fees.

- Free 24-Hour emergency assistance nationwide.

- Color repairs throughout your contract

-

Coverage condition

Coverage condition

Document title File size Terms of Coverage Motor Insurance Type 3 Plus (3+) 306 Kb

ประกันภัยรถยนต์-ภาคบังคับ (พ.ร.บ)

กฎหมายบังคับให้รถยนต์ทุกคันที่จดทะเบียนกับการขนส่งทางบกจะต้องมีการประกันตาม พ.ร.บ. ซึ่งคุ้มครองผู้ประสบภัยจากอุบัติเหตุรถยนต์ ไม่ว่าจะเป็นผู้ขับขี่ ผู้โดยสาร คนเดินเท้า หากได้รับความเสียหายแก่ชีวิต ร่างกาย รวมไปถึงทายาทของผู้ประสบภัยข้างต้น ในกรณีผู้ประสบภัยเสียชีวิตDetails of coverage

Display all the information

Hide all the information

-

In what cases does this plan cover?

In what cases does this plan cover?

ค่าเสียหายเบื้องต้น

ความคุ้มครอง จำนวนเงินจำกัดความรับผิด บาดเจ็บจ่ายค่ารักษาพยาบาลตามจริง ไม่เกิน 30,000 บาท/คน เสียชีวิตจ่ายค่าปลงศพ 35,000 บาท/คน ค่ารักษาพยาบาลรวมค่าปลงศพ ไม่เกิน 65,000 บาท/คน ความรับผิดต่อผู้ประสบภัย

ความคุ้มครอง จำนวนเงินจำกัดความรับผิด กรณีเสียชีวิต วงเงินคุ้มครองสูงสุด (2.1) 300,000 บาท/คน กรณีทุพพลภาพถาวร 300,000 บาท/คน กรณีสูญเสียอวัยวะ 200,000 - 300,000 บาท/คน กรณีบาดเจ็บ แต่ไม่ถึงกับสูญเสียอวัยวะ

หรือทุพพลภาพ ค่ารักษาพยาบาลตามจริง (2.3)ไม่เกิน 80,000 บาท/คน กรณีรักษาพยาบาลในฐานะคนไข้ใน

ชดเชยรายวัน 200 บาท/วัน ไม่เกิน 20 วัน (2.4)ไม่เกิน 4,000 บาท/คน จำนวนเงินคุ้มครองสูงสุดสำหรับ 2.1+ 2.2 + 2.3 + 2.4 รวมกัน ไม่เกิน 304,000 บาท/คน -

Coverage condition

Coverage condition

ชื่อเอกสาร ขนาดไฟล์ เงื่อนไขความคุ้มครอง ประกันภัยรถยนต์-ภาคบังคับ (พ.ร.บ) 213 Kb

Pay-Per-Use motor Insurance

For the first time, Pay-Per-Use motor insurance is a new kind of motor insurance which offer control over your insurance expenses by allowing on and off coverage through your smartphone application. No drive, No pay.Details of coverage

Display all the information

Hide all the information

-

What type of car is best suited for this type of insurance?

What type of car is best suited for this type of insurance?

Best suited for everyone who value worthiness and fairness and those who choose to turning coverage on or off

-

In what cases does this plan cover?

In what cases does this plan cover?

Freely choose your coverage. Premium starts from 600 baht. 4 packages available.

-

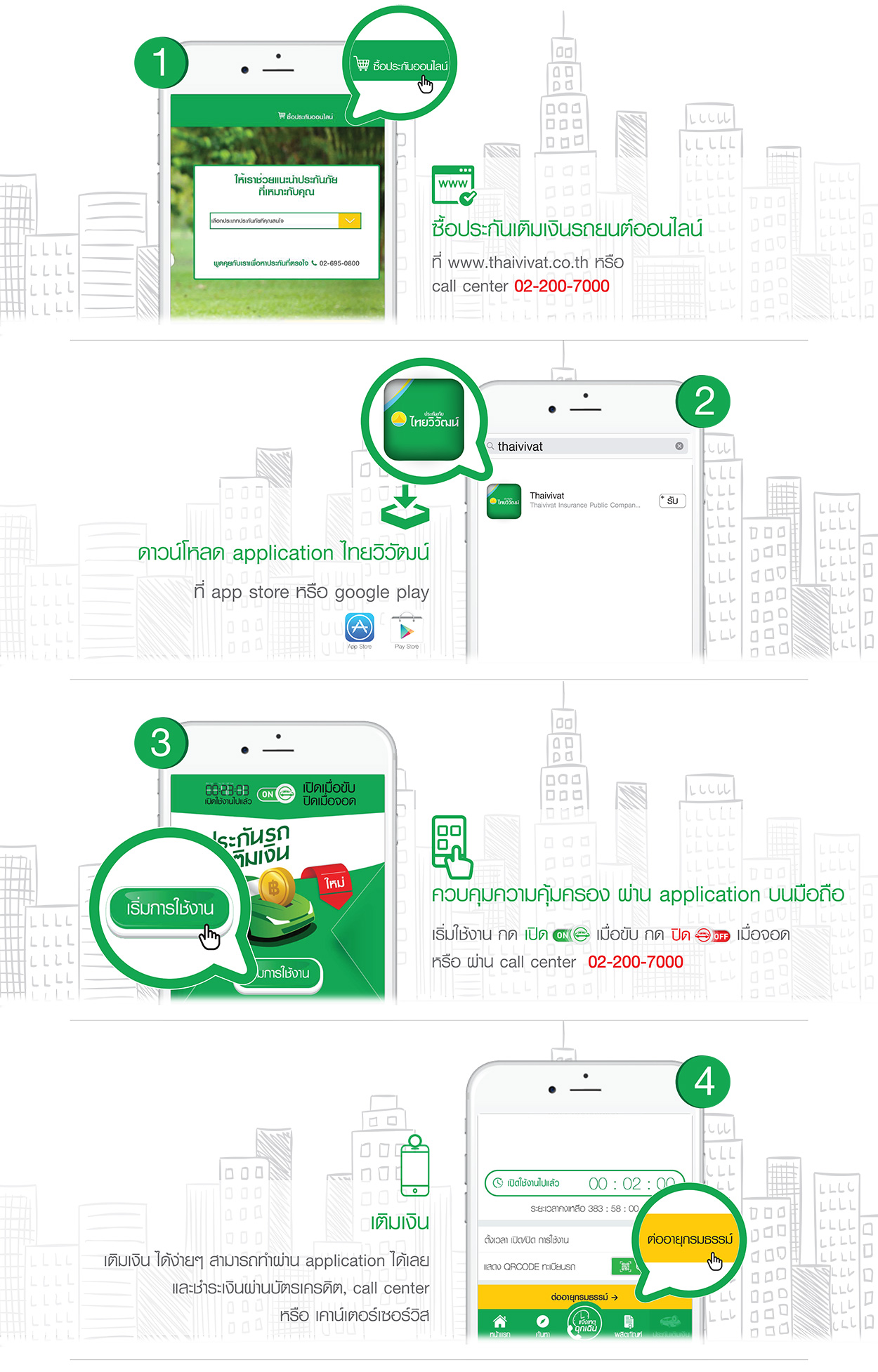

How to use

How to use

-

Coverage condition

Coverage condition

Document title File size Terms of Coverage Motor Insurance Type 1 1410 Kb Terms of Coverage Motor Insurance Type 2 Plus (2+) 1700 Kb Terms of Coverage Motor Insurance Type 3 Plus (3+) 306 Kb